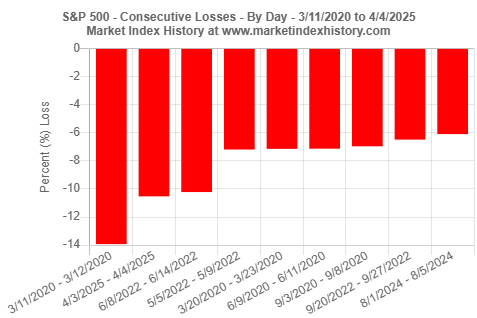

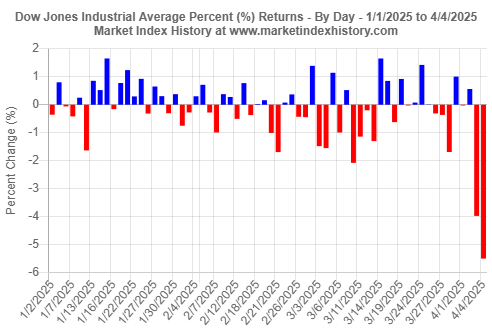

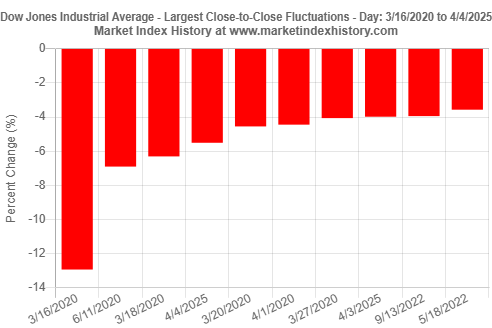

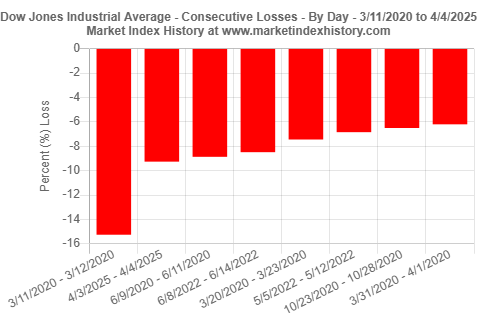

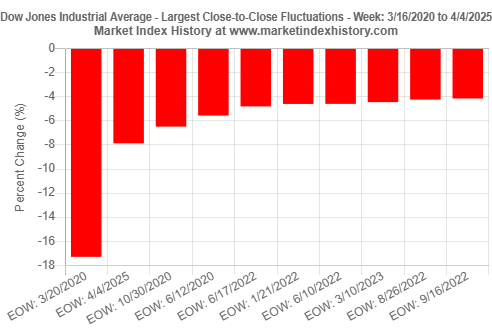

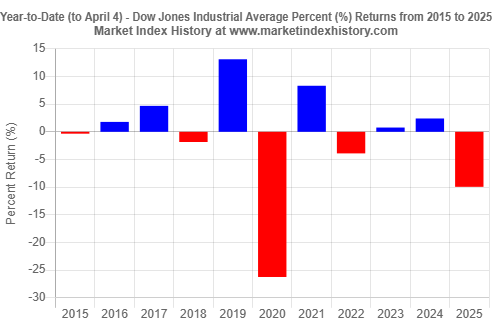

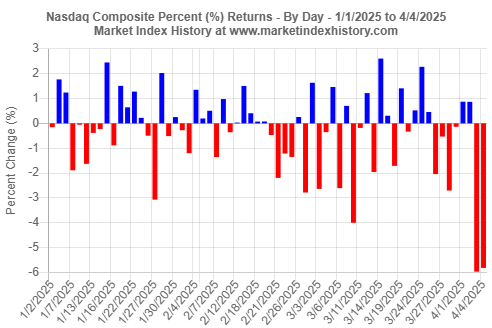

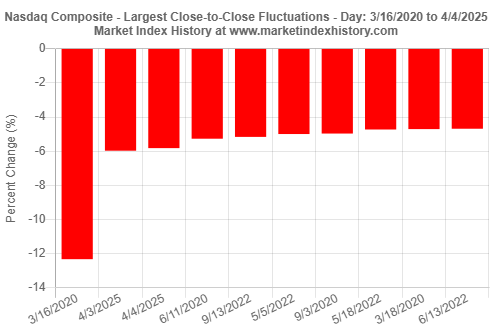

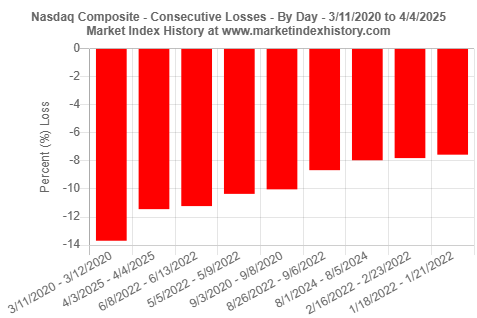

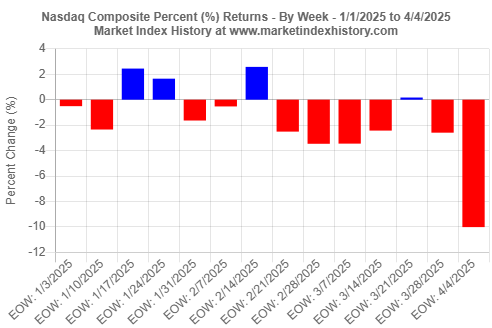

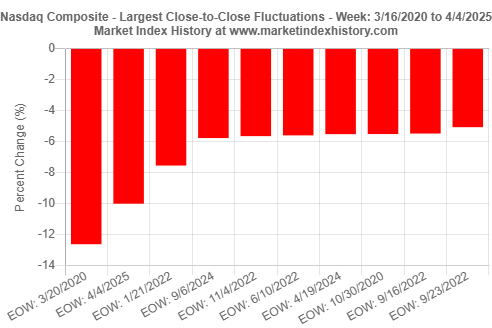

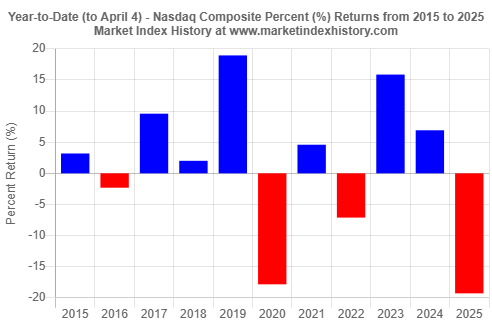

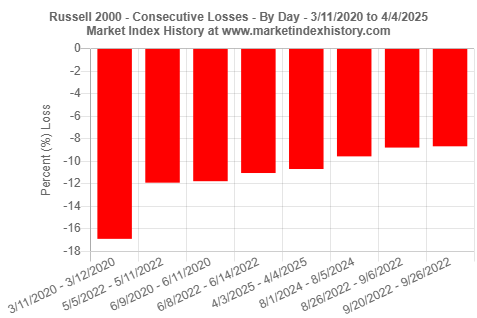

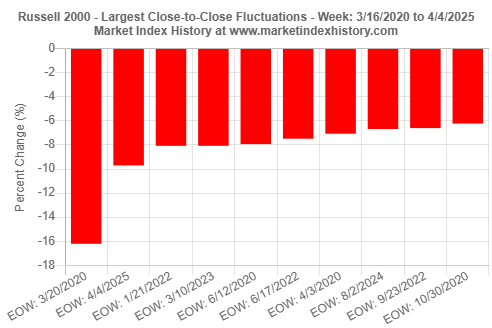

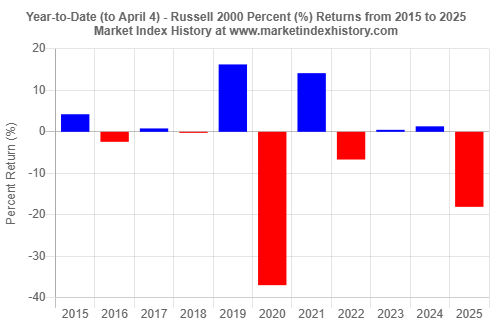

We have now completed two trading sessions following the announcement of new and broad tariffs placed on U.S. trading partners. In the last two days, institutional and retail investors have reacted very strongly to these tariffs, rapidly accelerating the market sell-off that started several weeks ago in anticipation of a market shake-up, and adding significantly to year-to-date market losses. All four major U.S. market indices were down significantly today, adding to already big losses incurred yesterday. Single-day losses, consecutive two-day losses, single-week losses, and year-to-date losses for all four market indices are similar to the large losses we experienced early in the COVID-19 pandemic in 2020. Year-to-date in 2025, the U.S. markets have shed trillions of dollars. For each market index, we have prepared six (6) charts that show these extraordinary observations.

Stock Market Wealth Evaporation Continues with Year-to-Date Losses in the Trillions - April 4, 2025

Friday, April 4, 2025

Please wait while we receive your comments...

Go to Dow Jones Industrial Average charts

Go to Nasdaq Composite Index charts

Go to Russell 2000 Index charts

S&P 500 Index

Dow Jones Industrial Average

Nasdaq Composite Index

Russell 2000 Index

To gain additional historical insights about market index performance, use any one of our Market Index Analysis tools.