On Friday, June 27, 2025, the S&P 500 index and Nasdaq Composite index set new all-time high records. The new all-time high record set by the S&P 500 was 6,173.07, 0.47% higher than the previous record of 6,144.15 set on February 19, 2025. This new record brings the total number of new S&P 500 all-time high records to four in 2025. The new all-time high record set by the Nasdaq Composite index was 20,273.46, 0.49% higher than the previous record of 20,173.891 set on December 16, 2024. This is the only new Nasdaq Composite all-time high record in 2025. The Dow Jones Industrial Average has not had a new all-time high record since December 4, 2024 (45,014.04). The Russell 2000 index has not had a new all-time high record since November 8, 2021 (2,442.74).

S&P 500 Index and Nasdaq Composite Index Set New All-Time High Records - June 27, 2025

Please wait while we receive your comments...

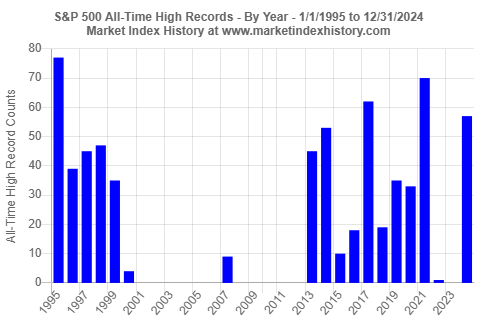

We used our All-Time High Records in Market History analysis tool to examine all-time high records set by the four major US market indices (Figures 1 to 4). The S&P 500 index set a new all-time high record on Friday, June 27, 2025 at 6,173.07, which was 0.47% higher than the previous record of 6,144.15 set on February 19, 2025. This constitutes the fourth new S&P 500 all-time high record in 2025 (Figure 1).

Going back 30 years to 1995, the S&P 500 index has exhibited a wide range of new all-time high records set during any given year. The number ranges from 77 new all-time high records in 1995 to none for several years including most recently in 2023 (Figure 2). The top five years for setting new S&P 500 all-time high records were 1995 (77 records), 2021 (70 records), 1964 and 2017 (62 records for each), and 2024 (57 records).

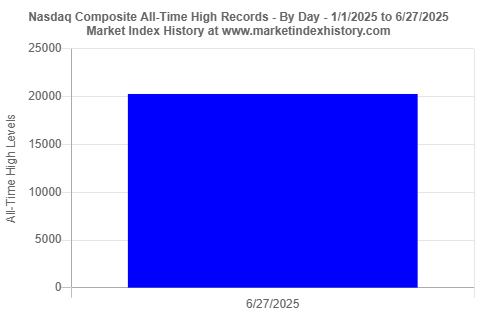

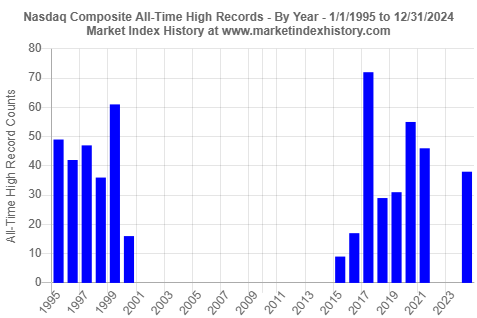

The Nasdaq Composite index also set a new all-time high record on Friday, June 27, 2025 at 20,273.46, which was 0.49% higher than the previous record of 20,173.891 set on December 16, 2024. This is the only new Nasdaq Composite all-time high record in 2025 (Figure 3).

Going back 30 years to 1995, the Nasdaq Composite index has exhibited a wide range of new all-time high records set during any given year. The number ranges from 72 new all-time high records in 2017 to none for several years including most recently in 2023 (Figure 4). The top five years for setting new Nasdaq Composite all-time high records were 2017 (72 records), 1980 (62 records), 1991 (61 records), and 1983 and 2020 (55 records for each).

The Dow Jones Industrial Average has not had a new all-time high record since December 4, 2024 (45,014.04). The Russell 2000 index has not had a new all-time high record since November 8, 2021 (2,442.74).

To gain additional historical insights about market index performance, use any one of our Market Index Analysis tools. We use these analysis tools ourselves to gain insights into market performance and to highlight a variety of interesting observations in our historical insights articles.