As we closed the month of July, we used our publicly available analysis tools to place the performance of the Dow Jones Industrial Average within a historical context of market performance. In particular, we wished to better understand how Dow Jones Industrial Average performance in July 2025 compared to performance in July of previous years.

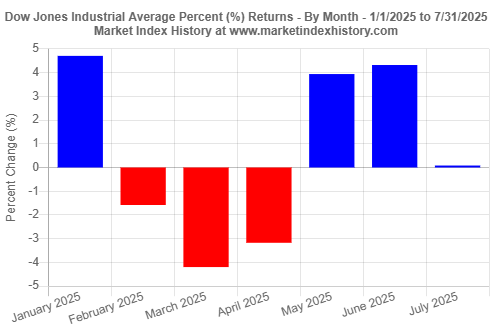

The Dow Jones Industrial Average had a small positive return of 0.08% in July 2025 (Figure 1). In fact, the gain in July 2025 represented the third consecutive month of positive returns for the Dow Jones Industrial Average (Figure 1).

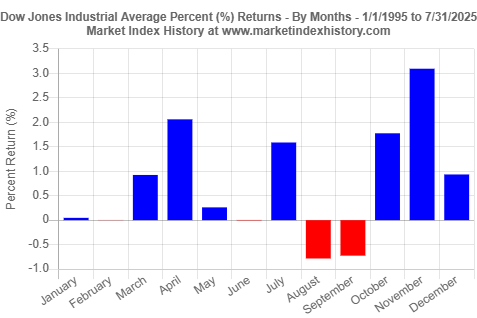

We then examined the historical performance of the Dow Jones Industrial Average for the month of July. Historically and on average, the Dow Jones Industrial Average has shown positive returns in July. Figure 2 shows average monthly (January to December) returns from January 1995 to July 2025. Based on this 31-year dataset, the Dow Jones Industrial Average has exhibited an average return of +1.59% in July.

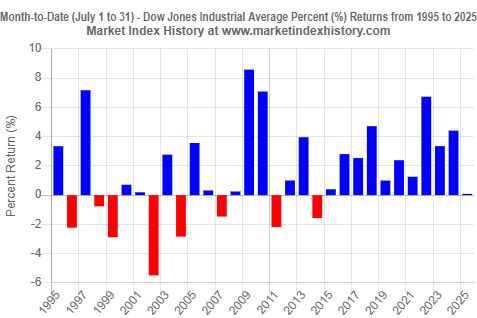

To delve deeper into the analysis shown in Figure 2 with a focus on the month of July, we examined the Dow Jones Industrial Average performance for every July from 1995 to 2025 (Figure 3). In July 2025, the Dow Jones Industrial Average had a gain of 0.08%. As shown in Figure 3, there is great variability with respect to returns in the month of July. On average, however, during the period examined, the Dow Jones Industrial Average has shown positive returns in July (see Figure 2 above).

Unlike the S&P 500 index and Nasdaq Composite index that had multiple new all-time high records in July 2025, the Dow Jones Industrial Average did not reach new high levels in July 2025. In fact, the Dow Jones Industrial Average has not had a new all-time high record since December 4, 2024 (45,014.04).

Summary

The Dow Jones Industrial Average had a small gain of 0.08% in July 2025, marking three (3) consecutive months of positive returns from May 2025 to July 2025. As of the end of July 2025, year-to-date return for the Dow Jones Industrial Average is +3.73%.

To gain additional historical insights about market index performance, use any one of our Market Index Analysis tools. We use these analysis tools ourselves to gain insights into market performance and to highlight a variety of interesting observations in our historical insights articles.