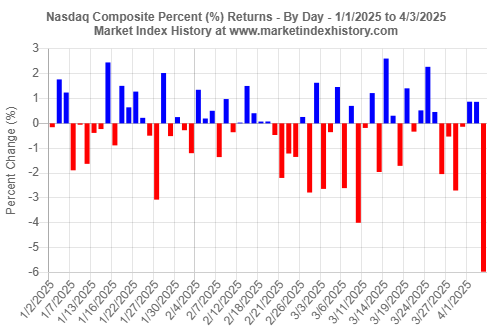

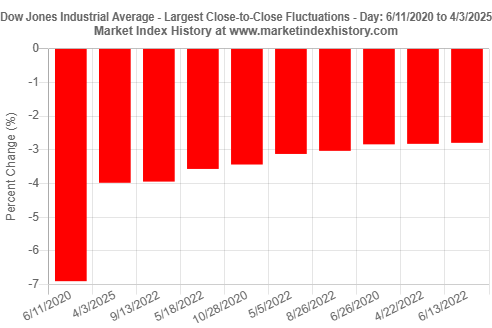

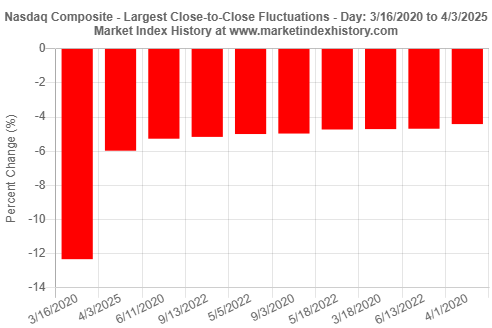

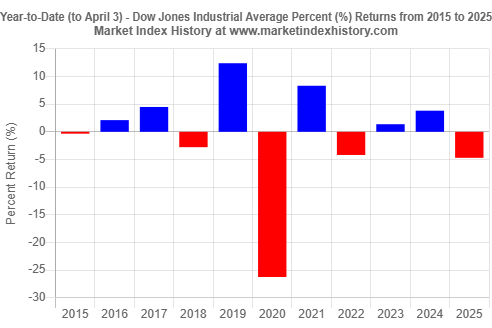

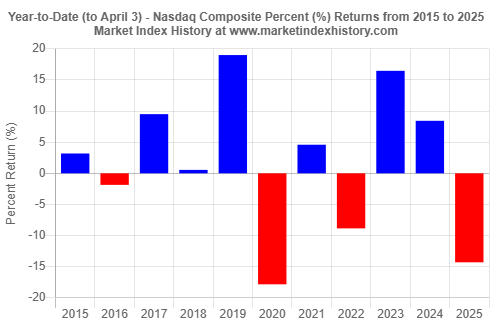

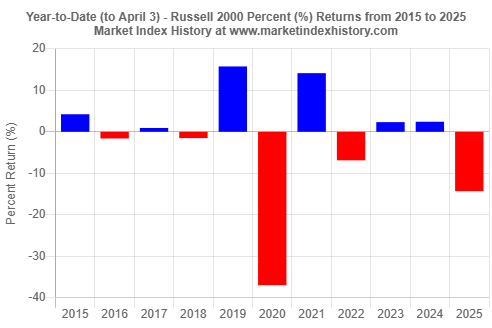

On Thursday, April 3, 2025, investors reacted strongly to new and broad tariffs placed on U.S. trade partners. All four major U.S. market indices were down significantly today. The S&P 500 lost 4.8%, Dow Jones Industrial Average gave back 4.0%, Nasdaq Composite index declined by 6.0%, and Russell 2000 index decreased by 6.6%. To find single-day losses of similar magnitudes, we will have to look back to the COVID-19 pandemic era of 2020. The losses today added to already growing losses for the year. Year-to-date, returns are -8.2% for the S&P 500, -4.7% for Dow Jones Industrial Average, -14.3% for Nasdaq Composite, and -14.3% for Russell 2000. We have prepared twelve (12) charts that show these market reactions.

Big Stock Market Pull-Back Signals Strong Investor Jitters – April 3, 2025

Thursday, April 3, 2025

Please wait while we receive your comments...

To gain additional historical insights about market index performance, use any one of our Market Index Analysis tools.